All Lines of Business

New Select Health Wellness Rewards – Get Fit, Get Rewarded

Select Health Wellness Rewards offer eligible members simple ways to engage in healthy activities while earning monthly incentives. Members can choose one of the following three reward options:

- Sworkit Activity — Earn up to $5 per week

Complete 150 minutes of physical activity, meditation, or stretching using Sworkit.

*New in 2026 (See more below)

View details

- Gym Membership — Earn up to $20 per month

Maintain an active gym membership

View details

- Daily Steps — Earn up to $20 per month

Track 7,000 steps per day at least 20 times in a calendar month through Personify Health.

View details

Each option includes an annual maximum of $240 per person or $580 per family.

Members can get started by logging in or creating a Select Health account.

*Sworkit Participation — What’s New in 2026

Members using the Sworkit option can earn up to $5 per week by completing 150 minutes of qualifying activity. Minutes may include:

- Any Sworkit workout, stretch, or meditation

- Manually added minutes for activities completed outside the app

- Active minutes recorded through a synced fitness device

View the Sworkit tutorial and FAQs

Small Employer

Agent Support Contact Guide

We want to make sure you can access the correct department at Select Health in the most efficient way possible. Below is a quick reference list of commonly used phone numbers and when to use them.

Member and Pharmacy Services

For benefits and claims questions.

800-538-5038

- Select Option 2 for Pharmacy

- Weekdays from 7:00 a.m. to 8:00 p.m. MST

- Saturdays from 9:00 a.m. to 2:00 p.m. MST

Member Advocates

Assists members with locating in-network providers.

800-515-2220

- Weekdays from 7:00 a.m. to 8:00 p.m. MST

- Saturdays from 9:00 a.m. to 2:00 p.m. MST

Agent Information Line

800-442-5306

Use the following menu options based on your needs:

- Select Option 2 for Sales

- Select Option 3 for Agent Experience

- Select Option 4 for Commissions

- Select Option 5 for Billing

- Select Option 6 for Enrollment

Form 1095-B Tax Information

Select Health provides 1095-B forms for all Commercial and Small Employer Level-Funded members. These forms are available through the Member Portal on our website. Any required employer-level tax filing must be completed by the employer.

Mineral Broker Power Sessions for Q1 2026

Thank you to everyone who joined last month’s Broker Power Session. It was great to see agents looking for ways to better support their Select Health client groups and prospects.

As we approach our next session, keep in mind that the Mitratech Mineral platform is a no-cost value-add for your Select Health small employer groups. In a market of rising costs, helping your clients understand the premium HR and compliance solution that comes with their Select Health plan is a powerful way to stand out.

These 15-minute power sessions are designed to provide you with practical talking points you can use in coversations with employer groups. Each session highlights 2-3 focus areas that may help differentiate your services, support clients’ needs, and encourage them to take full advantage of the resources available through their Select Health Small Employer plan.

Topics scheduled for the remainder of Q1 are available via the registration link.

Quick Action Items:

- Watch & Share: A short video to help clients access their Mineral account.

- Resource Check: Visit the Select Health Toolkit for Brokers.

- Stay in the Loop: Sign up for the Mineral Newsletter for ongoing updates.

Small Employer Dental Coverage

New 2026!

Beginning in 2026, employers in Idaho now have the option to enhance their benefits package by adding dental coverage through Delta Dental of Idaho. These plans offer the same flex plan options and rates available through a direct Delta Dental of Idaho arrangement, with the added convenience of consolidated billing through Select Health.

Idaho underwriting requirements

Please note the following guidelines for Idaho groups:

- Groups must maintain a minimum of two (2) enrolled employees.

- Minimum enrollment of 35% of eligible employees is required.

- Dental offices are not eligible for this product.

Dental Options Across Idaho, Nevada, and Utah

Small employers in Idaho, Nevada, and Utah may include dental benefits with their medical plans. This includes SE, Level Funded, and Association groups. A variety of plan options are available to support different employee needs.

For Utah dental plans, employers may also access a discount when dental and medical coverage are purchased together.

Offering dental coverage can help employers build a more comprehensive benefits package, while allowing employees access to preventive services, orthodontic coverage options, and networks of reputable providers.

Dental Coverage by State

- Idaho - Delta Dental of Idaho

- Nevada - Delta Dental

- Utah - Select Health Dental

For more information, please visit:

Individual

Reconcile Your Book of Business

If you haven’t already, please take time to review your Individual book of business and make sure you are listed as the Agent of Record (AOR) for every client you support.

Important: AOR changes made through the Federally Facilitated Marketplace are not complete until a signed AOR letter is uploaded in Select Health Link.

How to Run Your Book of Business in Link

- From the main landing page, hover over Individual and choose Member Search/Maintenance.

- Use the search bar to look up a specific member.

- To download your full book of business, select Search or Download Book to export the report to Excel.

If you notice any clients missing from your commission statement or your book of business, submit an AOR letter through the Link upload tool. Go to Agent Tools on the homepage and select Individual Agent of Record Request. The AOR form is available for download on this page.

Agent of Record Request (AOR)

Agent of Record forms may be submitted with either a physical signature or a digital signature. When submitting a digitally signed AOR, please make sure the document includes the signature certification time stamp. Failure to provide this time stamp may result in the denial of your request.

If you have questions on submitting an AOR, please contact amy.koncar@selecthealth.org.

HSA Eligibility for Bronze Plans

Recent legislation now allows all Individual Bronze plans offered through the ACA Exchange, as well as their off-Exchange equivalents, to qualify as HSA-eligible plans.

Select Health members enrolled in an Individual Bronze plan, or any other eligible Individual High-Deductible Health Plan (HDHP), may receive a $25 match from HealthEquity if they open a new HSA by April 30, deposit at least $25, and maintain a minimum balance of $25 for 90 days.

For questions about HealthEquity HSA accounts, please contact 866-346-5800.

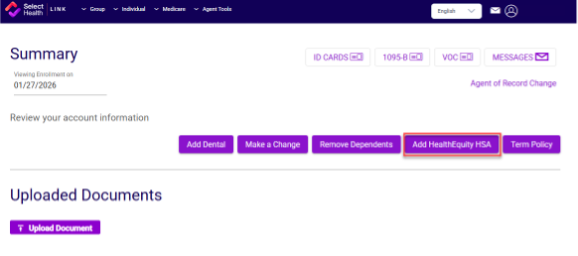

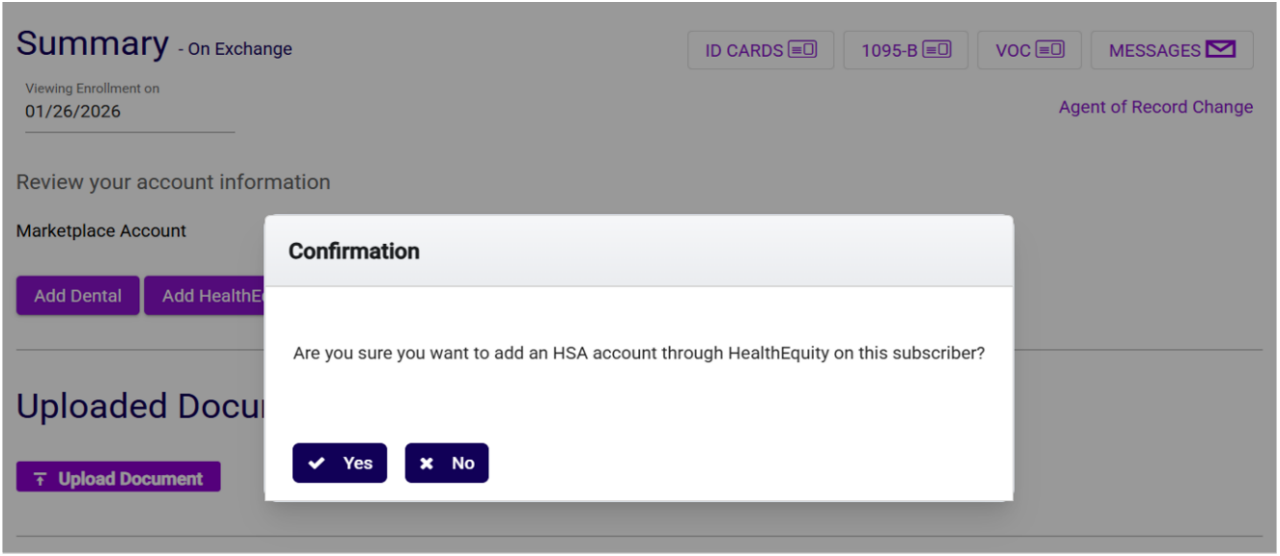

How to Add a HealthEquity HSA in Link

Follow these steps to start the HSA setup process for a member:

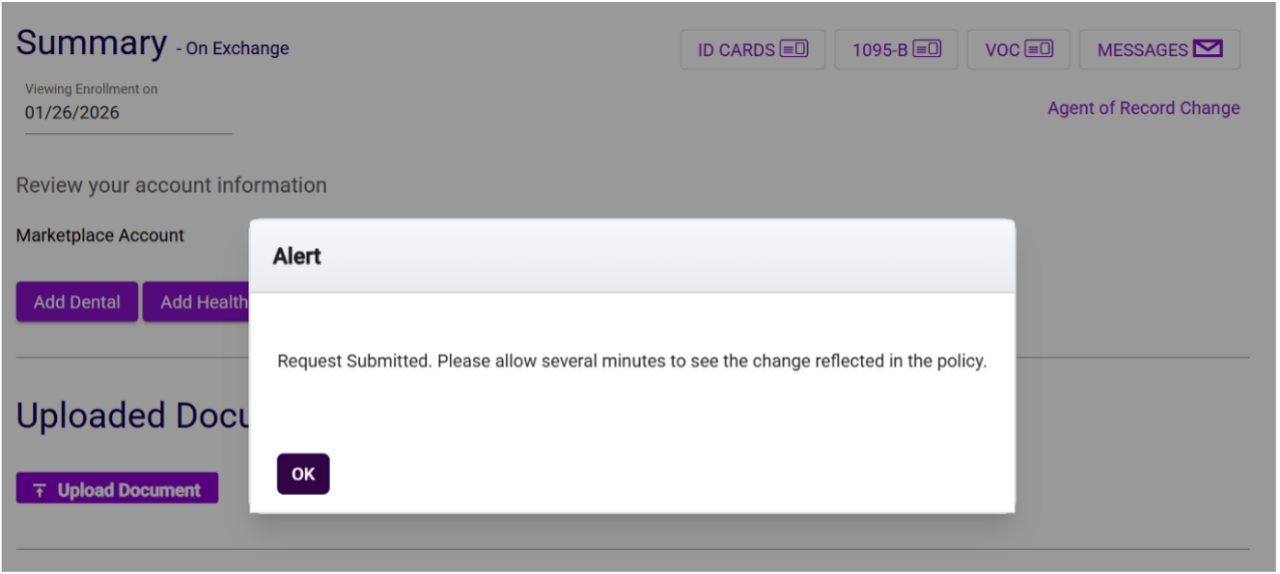

1. Navigate to the member's Summary page in Link

2. Select the Add HealthEquity HSA button.

3. Select Yes to confirm

After submission, please allow some time for the update to process. Select Health will send the member’s information to HealthEquity, and HealthEquity will reach out to the member directly to complete the HSA setup.

Large Employer

HSA Overview for Agents: What You Need to Know

Health Savings Accounts (HSAs) continue to be a valuable option for members enrolled in qualified High Deductible Health Plans (HDHPs). Below is an overview to help you talk with clients about how HSAs work within Select Health offerings.

What is an HSA?

An HSA is a tax-advantaged account members can use for qualified medical expenses such as deductibles, copays, dental services, and prescriptions. To contribute, members must be enrolled in an HSA-eligible HDHP.

HDHP Options Available for Large Employers

Utah

- Select Health Value

- Select Health Med

- Select Health Care

- Select Health Share

Idaho

- Select Health Med

- Select Health Network

- Select Health Standard

Why Employers Consider HSA-Eligible Plans

- Lower Premiums

HDHPs generally have lower monthly premiums compared to traditional plan designs. - Tax-Advantaged Savings

HSA contributions and qualified withdrawals receive tax benefits, and unused funds roll over from year to year - Member Control and Flexibility

Members can reimburse themselves for qualified expenses and keep unused funds as their balance grows over time - Optional Employer Contributions

Some employers choose to contribute to employee HSAs. - Additional Long-Term Uses

After age 65, members may use HSA funds for non-medical expenses without penalty (regular income tax may apply). Funds may also be used to pay Medicare premiums once enrolled.

Contribution Limits for 2026

- Individual Coverage: $4,400

- Family Coverage: $8,750

- Catch-Up Contribution: Add an additional $1,000

Select Health’s Preferred HSA Vendor – HealthEquity

We work with HealthEquity to administer HSAs. Our single sign-on (SSO) experience allows members to access their HealthEquity information through their Select Health account.

Members and employers with HSA questions can call HealthEquity Customer Service at 866-346-5800.